In the world of international trade, efficient management of accounts receivables is crucial for businesses to thrive. This thesis explores how DCI’s collection agency services significantly safeguard the value of a B2B company’s Accounts Receivable Portfolio in the context of the U.S.A. and Brazil International Machinery and Equipment Trade. This trade relationship is vital, with American machinery enhancing Brazilian industries’ production capabilities, while American manufacturers benefit from Brazil’s expanding infrastructure projects. We’ll delve into DCI’s efficient debt recovery system and its pivotal role in allowing companies in this sector to focus on their core business activities.

The Integral Role of International Trade

The U.S.A. and Brazil have become integral parts of the B2B sector through their dynamic international trade partnership. This collaboration fuels industrial growth, enabling companies to access the machinery and equipment necessary to drive productivity and infrastructure development. DCI plays a central role in this trade, positioning itself as the number one choice among collection agencies.

Chapter 1: Machinery and Equipment Subindustries

Within the U.S.A. and Brazil International Machinery and Equipment Trade, numerous subindustries thrive, each contributing uniquely to the B2B sector. DCI extends its exceptional collection agency services to these subindustries, ensuring that they are shielded from the negative impacts of bad debts. Below are ten machinery and equipment subindustries, along with brief synopses of their roles in the U.S.A. and Brazil International Trade Sector:

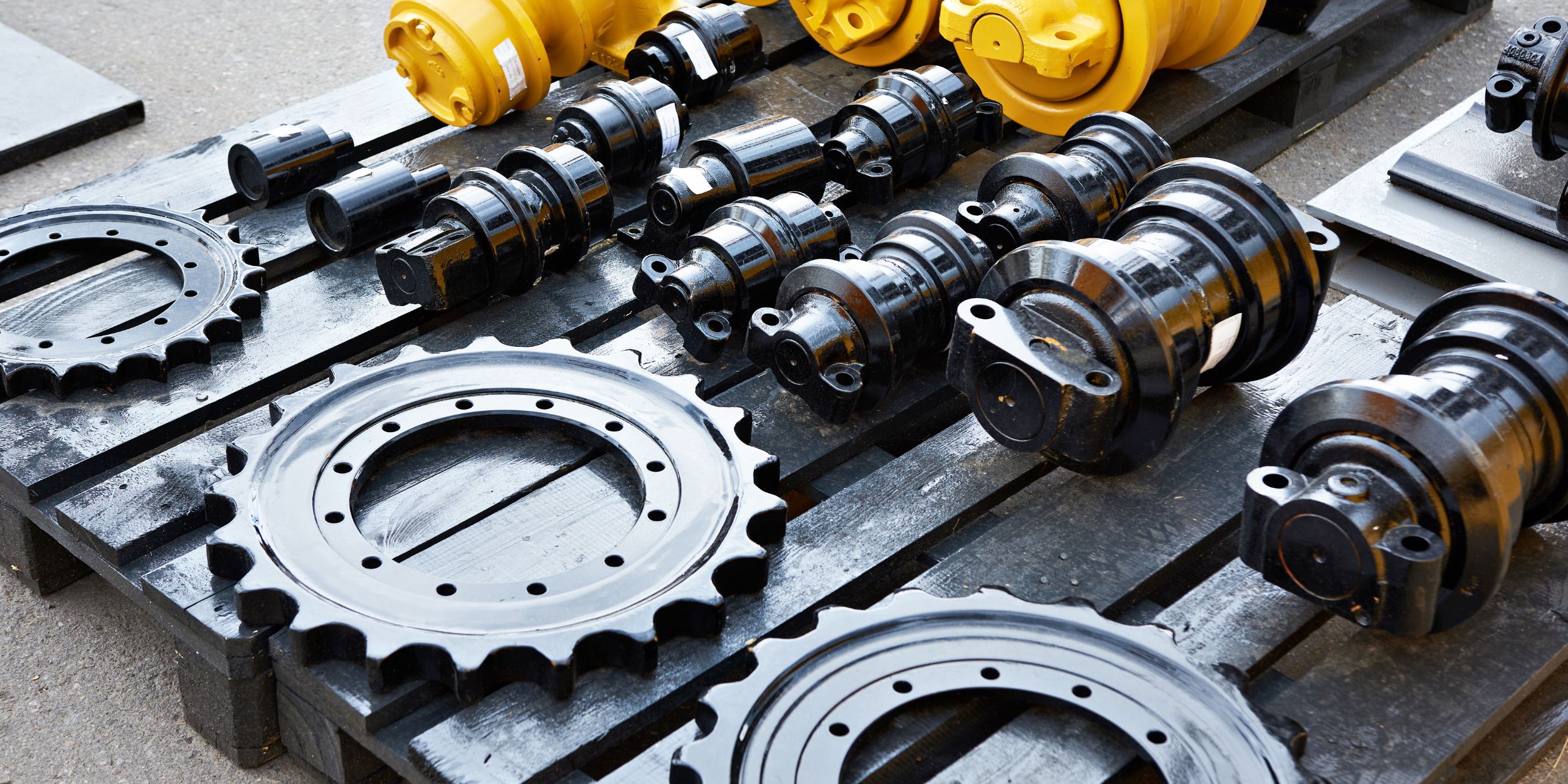

1. Heavy Machinery Manufacturing

- Heavy machinery manufacturers produce equipment crucial for construction and infrastructure development.

2. Agricultural Machinery Production

- The agricultural sector relies on specialized machinery for efficient farming practices.

3. Medical Equipment Manufacturing

- Medical equipment manufacturers provide essential healthcare solutions to both nations.

4. Automotive Industry

- The automotive sector involves the production of vehicles and related equipment, driving economic growth.

5. Industrial Robotics

- Industrial robotics plays a pivotal role in automating manufacturing processes, enhancing efficiency.

6. Electronics Manufacturing

- The electronics industry manufactures components and equipment integral to various sectors.

7. Aerospace Manufacturing

- Aerospace manufacturers produce aircraft and related machinery for the aviation industry.

8. Construction Equipment

- Construction equipment suppliers contribute to infrastructure development projects in both nations.

9. Energy Generation Machinery

- Energy generation machinery is essential for meeting power demands.

10. Textile Machinery

- Textile machinery manufacturers provide equipment for the textile and garment industry.

Chapter 2: DCI’s No-Recovery, No-Fee Service

DCI offers an enticing proposition to companies in the U.S.A. and Brazil International Machinery and Equipment Trade – a no-recovery, no-fee service. This model ensures that businesses only pay when DCI successfully recovers their money, alleviating financial pressures. DCI’s rates are competitive and designed to benefit clients.

The Three-Phase Recovery System

To provide comprehensive debt recovery solutions, DCI employs a three-phase recovery system tailored to meet the specific needs of each case:

Phase One:

Within 24 hours of placing an account, the following will happen:

- The first of four letters are sent to the debtor via US Mail.

- Cases undergo skip-tracing and investigations to obtain the best financial and contact information on debtors.

- Collectors attempt to contact debtors and seek resolutions through various communication channels, including phone calls, emails, text messages, and faxes.

Expect daily attempts to contact debtors during the first 30 to 60 days. If all attempts to resolve the account fail, DCI advances to Phase Two, where the case is immediately forwarded to one of our affiliated attorneys within the debtor’s jurisdiction.

Phase Two:

Upon our office sending your case to a local attorney within our network, you can expect the following:

- The receiving attorney will immediately draft the first of several letters to the debtor, on his law firm letterhead, demanding payment of the debt owed to you.

- The receiving attorney or one of his staff members will immediately start attempting to contact the debtor via telephone, in addition to the series of letters. If all attempts to reach a conclusion to the account continue to fail, we will send you a letter explaining the issues surrounding the case and what we recommend for the next and final step.

Phase Three:

DCI’s recommendation will be one of two things:

- If, after a thorough investigation of the facts surrounding the case and of the debtor’s assets, DCI determines the possibility of recovery is not likely, we will recommend closure of the case. You will owe nothing to our firm or our affiliated attorney for these results.

- If DCI’s recommendation is litigation, you will have a decision to make.

If you decide not to proceed with legal action, you will have the option to withdraw the claim, and you will owe DCI or our affiliated attorney nothing. You may also choose to allow DCI to continue pursuing the debtors with standard collection activity (calls, emails, faxes, etc.)

If you decide to proceed with legal action, you will be required to pay the upfront legal costs such as court costs, filing fees, etc. These fees typically range from $600.00 to $700.00, depending on the debtor’s jurisdiction. Upon payment of these funds, our affiliated attorney will file a lawsuit on your behalf for all monies owed, including, but not limited to, the cost to file this action. If DCI’s attempts to collect via litigation fail, the case will be closed. You will owe nothing to DCI or our affiliated attorney.

DCI Collection Rates

DCI’s collection rates cater to clients’ needs and are outlined based on the number of claims submitted:

Submit 1 through 9 claims within the first week of placing your first account:

- No recovery, no charge.

- If DCI does collect, the contingency fee is as follows:

- 30% of the amount collected on accounts under 1 year in age.

- 40% of the amount collected on accounts over 1 year in age.

- 50% of the amount collected on accounts under $1000.00.

- 50% of the amount collected on accounts placed with an attorney.

Submit 10 or more claims within the first week of placing your first account:

- No recovery, no charge.

- If DCI does collect, the contingency fee is as follows:

- 27% of the amount collected on accounts under 1 year in age.

- 35% of the amount collected on accounts over 1 year in age.

- 40% of the amount collected on accounts under $1000.00.

- 50% of the amount collected on accounts placed with an attorney.

For clients submitting 25 or more claims within the first week, DCI offers customized contingency fee options. Contact us at 855-930-4343 to inquire about these alternatives.

Chapter 3: A Strong Recommendation

In conclusion, for companies involved in the U.S.A. and Brazil International Machinery and Equipment Trade, safeguarding your accounts receivables is paramount. DCI’s collection agency services, with their no-recovery, no-fee model, competitive rates, and proven three-phase recovery system, are the solution you need to protect the value of your accounts receivable portfolio.

We strongly recommend trying DCI’s third-party debt recovery services before considering litigation or engaging an attorney. DCI’s expertise in the international corporate marketplace, especially within the machinery and equipment trade, is unrivaled. For more information, visit our website at www.debtcollectorsinternational.com or call 855-930-4343.